Your Operating Model Needs To Be As Innovative As Your Science: An Open Letter To CEOs And Boards Of Directors Of CGT Companies

By Omkar U. Kawalekar, Rohan Gupta, and Amit Agarwal, Deloitte Consulting LLP

In this three-part series of strategic insights for cell and gene therapy (CGT) CxOs and senior executives, we have discussed the importance of elevating critical decisions in manufacturing and the enabling digital ecosystem to the C-suite of any CGT organization. This article is part 3 of the series. It is directed at the Chief Executive Officer (CEO) and the Chief Operating Officer (COO). Here we discuss considerations in developing and deploying a short- and long-term operating model. Applying lessons learned from small and large CGT companies will accelerate timelines for companies to build the right organization and expedite CGT product launches.

Early-stage companies fuel scientific innovation in the CGT industry. By tapping abundant private and public funding, these start-ups act as innovation engines that push the boundaries of science and technology to bring curative therapies to patients. In the early stages of CGT company evolution, the operating model is all about hiring and retaining key scientific/technical talent. Secondarily, it focuses on building an organizational structure that supports nimble decision making by a small cohort of executives. Most early-stage CGT companies do not need or want a structured operating model that adds bureaucratic barriers and slows down the critical proof of concept achievement.

However, even before the satisfaction of this achievement fades away, executive teams and Board members of a CGT company should start to create a new fit-for-purpose operating model. We have seen deep-pocketed investors approach CGT companies with the expectation that the target CGT company can scale at unprecedented speed. Large pharmaceutical companies have approached other companies for mergers and acquisitions. Other CGT companies negotiate licensing deals with substantial up-front payments and back-end milestones. All these outcomes put pressure to grow rapidly and require a new operating model. Executive teams must quickly determine their future operating model or they could face a difficult road in meeting investor, acquirer, and partner expectations.

However, even before the satisfaction of this achievement fades away, executive teams and Board members of a CGT company should start to create a new fit-for-purpose operating model. We have seen deep-pocketed investors approach CGT companies with the expectation that the target CGT company can scale at unprecedented speed. Large pharmaceutical companies have approached other companies for mergers and acquisitions. Other CGT companies negotiate licensing deals with substantial up-front payments and back-end milestones. All these outcomes put pressure to grow rapidly and require a new operating model. Executive teams must quickly determine their future operating model or they could face a difficult road in meeting investor, acquirer, and partner expectations.

Essential Design Principles for your New CGT Operating Model

A foundational design principle is that CGT commercialization requires a unique operating model. Traditional pharmaceutical operational models are designed to push R&D products toward commercialization as quickly and efficiently as possible. Many of the processes are developed around products and are push based. These models do not always translate seamlessly to CGTs where the processes need to be designed around a patient, are clinical connected, require a transcending of existing functional barriers and are pull based. We have heard from multiple industry leaders that force-fitting CGT models into traditional pharma archetypes can fundamentally sabotage the rapid growth of CGT organizations. They report such problems as slow commercialization, inefficiency, and redundancies.

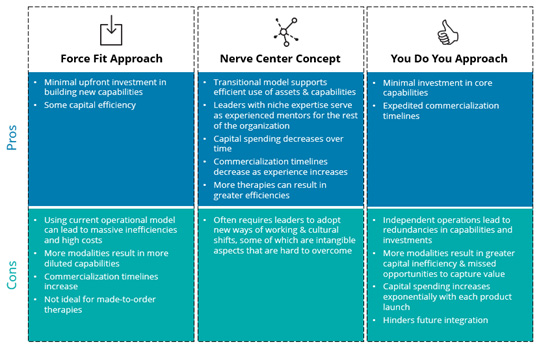

In the CGT world, commercial organizations no longer single-handedly drive product development and launch. The supply chain and operations function becomes the central focus, so roles, responsibilities, coordination, and organizational hierarchies morph. New operating models could accommodate high variability in development timelines and therapy-specific value chains. To date, we have witnessed two approaches; the ‘Force-Fit Approach’ and the ‘You-Do-You Approach.’

The ‘Force Fit Approach’ describes when new therapy groups should use the existing capabilities & structure of the larger organization or when senior executives attempt to replicate the capabilities and structures from their previous biopharma experience. In either situation, the executive team typically assumes the CGT enterprise can be assimilated into the existing infrastructure with minimal investment and customization.

The ‘You Do You Approach’ describes a larger pharma partner providing some investment and core functionality. Still, the new CGT group operates largely independently, much like an biotech start-up.

While there is no right or a wrong way here, decisions on operating models depend largely on the life cycle of the organization and its CGT assets. Neither of the above approaches is optimal. Both intrinsically have trade-offs. Both fail to recognize the vast differences in CGT development and the unique expertise and practical experience required for CGT commercialization.

Another way we have observed is taking a bi-modal approach that extracts the needed expertise, capabilities, and processes from these models is a viable alternative. This tactic, applied within the context of a patient-focused, ‘pull’ paradigm rather than the traditional product-focused ‘push’ model, offers a transitional model that can lead to sustained success. We call it the CGT Nerve Center.

Figure 1: Comparison of CGT Operating Models

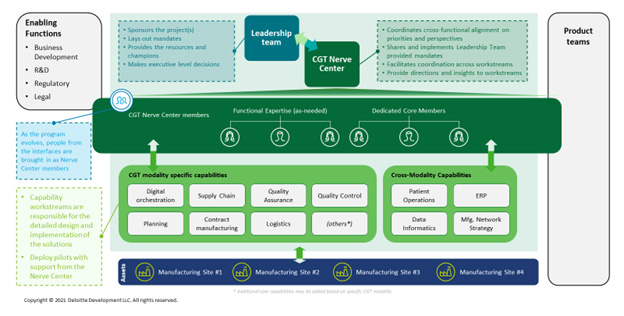

What is the CGT Nerve Center Concept?

A CGT Nerve Center consists of functional experts and dedicated core members who bring the right CGT experience to the table. It is a dedicated and nimble team that orchestrates efforts across CGT modalities and functions to enable rapid therapy development and launches. It is inspired by and adapted from the concept of a transformation nerve center.1

Figure 2: CGT Nerve Center Concept

The Nerve Center liaises with CGT functional leads and traditional product teams. It builds relationships with development and manufacturing asset teams. As the main point of contact for leadership, the Nerve Center guides and prioritizes program efforts and allocates shared resources across workstreams. They seek new opportunities to collaborate across workstreams and leverage internal and external knowledge to develop standards and best practices across the organization. They interface with other functions within the larger organization (e.g., patient services), enabling functions (e.g., IT, finance), and external interfaces (e.g., licensing partners). Their prior CGT experience informs hiring and development plans, and their end-to-end view of CGT programs ensures a holistic effort toward commercialization.

The Nerve Center model can serve as a transitional model until a company’s CGT operations mature. This method allows the rest of the organization to align with the new roles and work processes and prioritizes the leadership mandate for CGT industrialization.

The Nerve Center in Action: Borrowing from the High-Tech Industry

The high-tech industry serves as an excellent analog to draw lessons from where similar transitional models have been deployed. In high-tech, determining the correct operating model is a C-suite decision. It’s never too early to begin planning and start making decisions on a nerve center implementation. Once the transitional model is chosen, it is essential to address the challenges of organizational culture, funding, and communications surrounding the Nerve Center.

Acting as a transformative catalyst, the leadership team and Nerve Center members work toward organizational buy-in regarding their mission and agency. The organization must understand the rationale for pursuing new sources of value and recognize the role of the Nerve Center team in that pursuit. This understanding requires a mindset change that is initiated at the C-Suite level and continually reinforced across functions. A lack of clarity around the purpose of the Nerve Center can inhibit real progress. A technology executive who participated in the roll-out of a model like the Nerve Center commented on the time and patience required to gain organizational buy-in, “We were willing to be misunderstood for a long period of time, until we got our operating model right.”

The team is funded as a priority operation with a clearly defined budget that aligns with its goals. The budget characterizes the short and long-term vision. Milestones and performance metrics become part of the budgeting discussion.

The team is also empowered to make decisions without overhead administrative processes to ensure quick wins. Communicating these wins to build momentum across the organization is essential. Clear internal and external communications about plans and responsibilities introduce the Nerve Center to the organization and other stakeholders. This messaging comes directly from the C-suite. Frequent leadership communications reinforce the significance of the activities to the organization’s strategic plans. The leadership team can increase transparency, decrease risk, and build momentum toward a common goal by attending to and communicating potential challenges.

Practice-Based Takeaways

CGT Organizational leaders should reflect on the following matters as they design and implement a new operating model.

Leading practices create change. A willingness to take risks, prioritize effective communications, and embrace cultural shifts initiates change. Each organization is unique. Be the leading practice for your organization.

Culture and talent are fundamental within the Nerve Center team. An empowered Nerve Center team requires high performers with a bias for action and the ability to accept risk. These individuals are hard to find and harder to retain. Their critical role in building the organization's future requires vision, practical experience, and a host of soft skills to communicate, negotiate, and build consensus.

Grant sufficient autonomy so that these members are empowered to make decisions in a culture of innovation.

Align Metrics to break down functional barriers, parry individual functional metrics and focus on launch success. Meticulously articulate roles and responsibilities of the nerve center members so as to have them operate successfully in a heavily matrixed organization.

Conclusion

In 2020, the CGT market was valued at $2.6 billion, and it is expected to grow ~34% a year to ~$25 billion million by 2027.2 If pharma teams around the globe plan to expand their CGT portfolios, transitional operational models will be an important step in the journey. Organizations should design their operating models to address the unique requirements of CGT products to get the most from their investment dollars.

The Nerve Center Concept enables product teams to simultaneously support traditional product development and commercialization while adapting and evolving relevant capabilities to support CGT development and commercialization. It facilitates the organization's evolution, offering a hybrid approach that lies between the ‘Force Fit’ and the ‘You Do You’ models. By building on the best attributes of these opposing models, the Nerve Center Concept helps C-suite executives recognize the value of their investment and protect it moving forward. This approach ensures an accretive acquisition. This innovative concept offers an evolutionary operating model that supports revolutionary science.

Correspondence and Acknowledgement

The authors would like to extend a special thank you to Katie Lucey, Deloitte Consulting LLP, for her contribution to this work.

Please direct any correspondence regarding this article to Hussain Mooraj, lead for Deloitte Consulting LLP’s NextGen Therapy practice and New England regional lead for life sciences.

Author Bios

Omkar U. Kawalekar, PhD, is a manager in Deloitte Consulting LLP’s Strategy & Analytics practice and leads eminence for Deloitte’s NextGen Therapy practice. With a graduate degree in cell & gene therapy from the University of Pennsylvania, he has primarily worked with executives at small and large biotech companies, defining and implementing transformative capabilities as they develop, manufacture, and commercialize cell and gene therapies. He continues to present at numerous scientific conferences and publishes regularly in this field.

Omkar U. Kawalekar, PhD, is a manager in Deloitte Consulting LLP’s Strategy & Analytics practice and leads eminence for Deloitte’s NextGen Therapy practice. With a graduate degree in cell & gene therapy from the University of Pennsylvania, he has primarily worked with executives at small and large biotech companies, defining and implementing transformative capabilities as they develop, manufacture, and commercialize cell and gene therapies. He continues to present at numerous scientific conferences and publishes regularly in this field.

Rohan Gupta is a senior manager in Deloitte Consulting’s Strategy & Analytics practice, where he partners with clients to increase the lifetime value of their customers by driving transformative product launches, go-to-market strategy, and customer success programs. Rohan is also passionate about bringing the capabilities of the technology sector, including a fail-fast mindset, customer experience, and a bias for action, to other industries, and advises clients on digital transformation, building scalable sales and services capabilities, and operating model design. He holds an MBA from the Stern School of Business at NYU.

Rohan Gupta is a senior manager in Deloitte Consulting’s Strategy & Analytics practice, where he partners with clients to increase the lifetime value of their customers by driving transformative product launches, go-to-market strategy, and customer success programs. Rohan is also passionate about bringing the capabilities of the technology sector, including a fail-fast mindset, customer experience, and a bias for action, to other industries, and advises clients on digital transformation, building scalable sales and services capabilities, and operating model design. He holds an MBA from the Stern School of Business at NYU.

Amit Agarwal is a managing director in Deloitte Consulting’s life sciences practice. He has more than 25 years of management consulting experience and has led multiple projects in both strategy and operations. Agarwal co-leads the Next Gen Therapy practice, which focuses on advising clients on taking advantage of and/or developing strategic responses to new disruptive technologies which leapfrog older business models and establish new clinical practices. Agarwal has worked with life sciences clients in the U.S., Europe, and Asia on high-impact projects. He holds an MBA in finance and technological innovation from the MIT Sloan School of Management and a bachelor’s degree in history and pre-med from Occidental College.

Amit Agarwal is a managing director in Deloitte Consulting’s life sciences practice. He has more than 25 years of management consulting experience and has led multiple projects in both strategy and operations. Agarwal co-leads the Next Gen Therapy practice, which focuses on advising clients on taking advantage of and/or developing strategic responses to new disruptive technologies which leapfrog older business models and establish new clinical practices. Agarwal has worked with life sciences clients in the U.S., Europe, and Asia on high-impact projects. He holds an MBA in finance and technological innovation from the MIT Sloan School of Management and a bachelor’s degree in history and pre-med from Occidental College.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

Copyright © 2021 Deloitte Development LLC. All rights reserved

- https://www2.deloitte.com/us/en/insights/focus/industry-4-0/digital-transformation-nerve-center.html

- https://www.globenewswire.com/news-release/2021/03/05/2187807/28124/en/Global-25-Billion-Cell-and-Gene-Therapy-Market-to-2027-Focus-on-Product-Type-Therapeutic-Class-Pipeline-Regional-and-Country-Data.html