Genomics: The 2 Biggest Trends & An Unbiased Look At Vendors

By Tanvi Sapatnekar, senior research analyst — healthcare, MarketsandMarkets

Drug discovery and development are commonly conducted through in vivo and in vitro methods, which are very costly and time-consuming. Most drug candidates selected in the discovery phase fail in the late stages of development due to toxicity or other pharmacokinetic characteristics. Because of these factors, there is a need for alternative tools for discovering new drugs. Genomics is one such tool that is being used to accelerate drug development. Population genomics has identified numerous disease-susceptible genes and is helping to identify targets for drug discovery.

According to our new market research, the genomics market is estimated at $46.3 billion in 2023 and is projected to reach $83.2 billion by 2028 with a CAGR of 12.4% during the forecast period (2023–2028). The field is anticipated to grow at a considerable pace attributed to increasing innovation and competition, with a high influx of startups (nearly 8,000). These startup entities are engaged in developing sequencing platforms, technologies, platforms, software, and other analytical solutions.

Let’s look at the two biggest trends in genomics, as well as the prominent vendor companies operating in the space.

The 2 Biggest Trends In Genomics

1. Use Of CRISPR-Cas9 Gene Editing

A significant increase in the demand for CRISPR-Cas9 gene editing technology has emerged as one of the key drivers of the genomics market. CRISPR-Cas9 is a versatile tool for precise genome editing, preferred due to its simplicity, efficiency, and precision. The relatively high efficiency and broad applicability of this technique have opened the door to experiments that seemed difficult to carry out using other technologies, such as TALEN and ZFN. CRISPR-Cas9 technology is also gaining traction in the field of personalized medicine. CRISPR/Cas9 technology is applied in genome modification and investigation of tumor occurrence, development, and metastatic pathways. Use of CRISPR/Cas9 to investigate tumor etiologies has propelled the development of novel cancer therapies. CRISPR technology holds immense potential for advancing scientific research, medicine, and agriculture. However, effective regulatory strategies are important to address the ethical and safety implications associated with the use of CRISPR/Cas9 technology. Ongoing research and collaboration among scientists, policymakers, and manufacturers are anticipated to mitigate challenges associated with this powerful gene-editing tool.

2. Integration Of AI In Genomics To Manage Large Data Sets In Sequencing

The use of AI in genomics studies offers new insights into gene function and the ability to predict genetic risks in patients. Next-generation sequencing (NGS) generates around 120 GB/genome; a single sequencer can generate up to 4 TB of data per day. This vast and complex data set needs to be studied, and AI facilitates interpretation of this data. By interpreting vast amounts of genetic data, AI can help to identify patterns and correlations that would be difficult for scientists to see. This advanced information can then be used to develop new treatments for diseases, improve diagnostic accuracy, and personalize patient treatments.

Integration of AI in genomics has enabled faster and more efficient application in precision medicine. Autoimmune diseases, infectious diseases, and cancer have become increasingly difficult to treat using conventional methods that do not consider individual genetic, environmental, and lifestyle differences. Precision medicine software enables researchers and medical practitioners to enhance patient treatment and empowers individuals to monitor and take a more active role in their health. While AI implementation in medical care and management is still in its early stages, it showcases high potential by seamlessly integrating large-scale patient data.

AI algorithms are used to create synthetic patient populations with the properties of actual patient cohorts, build personalized and predictive models of drug combinations, and reveal complex relationships between diets, microbiomes, and genetic lineups to determine the comparative treatment response. AI-inspired machine learning methods leverage the volume and exponential growth of genomic data to translate genetic information into new unforeseen insights for safer, more effective, and cost-efficient personalized healthcare. Thus, the ability of AI to seamlessly integrate patient data and provide actionable insights can revolutionize precision medicine.

Let’s Look At The Vendors Operating In Genomics

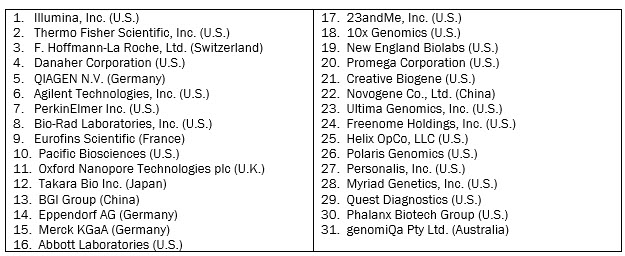

Listed in order of market share, the prominent companies operating in the space are:

The top five companies accounted for nearly half of the market share in 2022.

These companies are actively involved in the research and development of genomic products as well as the introduction of novel and cutting-edge technologies. Some of their recent strategic initiatives are:

- In June 2023, Illumina announced the launch of a new AI platform, PrimateAI-3D, which is designed to predict disease-causing genetic mutations in patients. This platform is built to enhance the ability to improve prediction of genetic risks in patients and drug target discovery using primate DNA and advanced artificial intelligence.

- In March 2023, Illumina launched a human whole-genome sequencing (WGS) assay compatible with Illumina NovaSeq X Plus, NovaSeq X, and NovaSeq 6000 sequencing systems for access to long- and short-read data on the same instrument.

- In February 2023, Thermo Fisher Scientific launched TrueMark STI Select Panel, a polymerase chain reaction (PCR) test designed to detect Chlamydia trachomatis, Neisseria gonorrhoeae, Trichomonas vaginalis, and Mycoplasma genitalium for research applications only.

- In December 2022, Agilent Technologies announced the opening of a new customer experience center (CEC) in Lexington, MA, focused on solutions from Agilent’s genomics and diagnostics product portfolios.

- In March 2022, Pacific Biosciences opened its European headquarters in London to better serve customers in Europe, the Middle East, and Africa.

Biotechs are increasingly looking to use genomics vendors’ capabilities in gene editing, gene analysis, sequencing, and integration of artificial intelligence. The industry is seeing an increase in collaborations and partnerships for the advent of novel technologies, such as:

- In 2023, Illumina and Myriad Genetics extended their partnership to provide homologous recombination deficiency (HRD) testing. Under this partnership, the TruSight Oncology 500 HRD test will be available in the U.S. for research applications.

- In 2023, Thermo and AstraZeneca signed an agreement to develop a solid tissue and blood-based companion diagnostic test for Tagrisso (osimertinib). The collaboration will utilize the next-generation sequencing (NGS) platform for developing NGS-based CDx testing.

- In 2023, Agilent signed a collaboration agreement with Quest Diagnostics to distribute Agilent’s Resolution ctDx FIRST liquid biopsy NGS test across laboratories in the U.S. The test is a companion diagnostic to identify advanced non-small lung cancer patients who may benefit from treatment with adagrasib (brand name Krazati).

- In 2023, Pacific Biosciences and the University of Tokyo collaborated for research in rare diseases by utilizing PacBio’s HiFi long thread sequencing data.

- In 2022, Illumina entered into a strategic research collaboration with AstraZeneca to improve the efficiency of pharma pipelines by leveraging the ability to identify genetic variants that contribute to human diseases.

- In 2021, Illumina collaborated with Helix to improve the national surveillance infrastructure in the U.S. to track the emergence and prevalence of novel strains of SARS-CoV-2 with support from the CDC. Illumina’s sequencing technology and expertise and Helix’s national COVID-19 testing footprint will significantly expand the country’s existing surveillance efforts to detect and characterize emerging variants of SARS-CoV-2.

Conclusion

The global genomics market is projected to grow at an exponential rate from 2023 to 2028. Robust government funding for genomics projects, an increase in prevalence of viral diseases and genetic disorders, expanding applications of next-generation sequencing in oncology, and entry of new players and startups in the genomics market are all driving growth. The ethical issues associated with genomics and a dearth of trained professionals will be challenges to tackle.

About The Author:

Tanvi Sapatnekar is a senior research analyst in the healthcare domain at MarketsandMarkets. With more than six years of experience, she has worked on market assessments for the pharmaceutical, biotechnology, and medical devices verticals, including for segments such as cell-based assays, regenerative medicine, genomics, microbiome sequencing, cell & gene therapy, single cell genomics, and next-generation sequencing.

Tanvi Sapatnekar is a senior research analyst in the healthcare domain at MarketsandMarkets. With more than six years of experience, she has worked on market assessments for the pharmaceutical, biotechnology, and medical devices verticals, including for segments such as cell-based assays, regenerative medicine, genomics, microbiome sequencing, cell & gene therapy, single cell genomics, and next-generation sequencing.