CombiChem Libraries Market In Transition

By Stefan H. Unger, Frost & Sullivan

The Market for Libraries: Changing, not Disappearing

Challenges Facing the Industry

New Report from Frost and Sullivan

Drug discovery is a numbers game. The well-known attrition rate of candidates screened to drugs on the market is dismal (commonly cited to be 5,000–10,000 to 1). With increasing pricing pressure on marketed drugs, escalating research costs and competition, and expiring patents on legacy cash cows, the pharmaceutical industry needs to improve its efficiency by learning to intelligently "stack the deck." One simple, but hopefully effective, strategy is to screen more compounds more efficiently: test more, discover more.

The introduction of robotic high throughput screening (HTS), with its ability to devour up to 100,000 samples per day per machine in mass screening, has given rise to an insatiable demand for new compounds. This demand will be further compounded by the anticipated flood of targets that will ultimately come from the Human Genome Project.

Historically, a medicinal chemist is able to synthesize 25—100 compounds per year, one-by-one, depending upon complexity. Clearly this classical approach is a totally unsatisfactory way to feed the HTS monster.

The Market for Libraries: Changing, not Disappearing (Back to Top)

Combinatorial Chemistry (CC, or "High Throughput Organic Synthesis") is an attempt to increase the productivity of medicinal chemists by synthesizing large numbers of compounds more-or-less in parallel with the help of robots using standardized chemistry (dozens to millions of compounds in one run, depending upon technology). The compounds are placed in special 96-well (or higher) plates and used in HTS robots that can screen up to 100,000 samples per day.

CC libraries are produced by specialist companies and in-house groups at pharmaceutical companies, as well as by being assembled from collected samples. Small-molecule libraries are also being produced by combinatorial biology technologies. Some small biopharma companies have also traded their in-house libraries in exchange for various rights, but not always for cash.

More than 30 companies produce libraries as a main component of their business, and we focus on this commercial market for libraries. The suppliers all use some combination of three "idealized" business models: catalog supply, contract service, and/or shared-risk.

The US commercial market for combinatorial chemistry libraries has been in turmoil as it evolves from emerging to mature status. The rules are changing as big pharmaceutical companies back away from the extensive milestone and royalty deals ("shared-risk") of the past and bring combinatorial chemistry technologies in-house, and as new, low-cost, royalty-free suppliers and distributors ("catalog"), or service oriented ("contract-service") companies enter the market.

Challenges Facing the Industry (Back to Top)

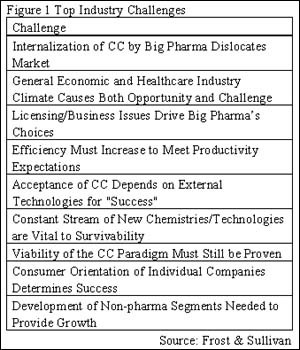

In a new industry report (details below), Frost & Sullivan discusses some of the major challenges facing the industry (see Figure 1):

1) Internalization of CC by Big Pharma Dislocates Market

The biggest single challenge to the industry is the fact that CC has been "successful" to the extent that big pharma has embraced the technology by bringing it in-house. This has had a mixed effect on the industry. Some companies have been acquired (e.g., HMR/Selectide, Lilly/Sphinx, duPont/CombiChem), and some have formed strong partnerships (Pfizer/Arqule), but most have had to struggle to adapt their business models to changing conditions. While the future will see more consolidation, commercial combinatorial chemistry library companies will still exist, but will have to find the right product and channel mix.

2) General Economic and Healthcare Industry Climate Causes Both Opportunity and Challenge

The general economic climate, and that of the healthcare industry in particular, will affect the demand for combinatorial libraries. Any scaleback in research funding will generally decrease demand for all research supplies. However, if CC/HTS is perceived as a productivity enhancing tool, demand for equipment, supplies, and libraries might actually increase. Unfortunately, the capital markets have not been active in funding combinatorial chemistry libraries companies recently.

3) Licensing/Business Issues Drive Big Pharma's Choices

When CC technology was new, big pharma was willing to trade a portion of the rights to newly discovered drugs (in the form of royalties) in order to gain access to the technology. However, there is now a trend toward unencumbered licensing of libraries and/or toward the build-up of in-house CC facilities. While novel intellectual property (IP) is always valued, licensing and business terms have become more important in this maturing market.

4) Efficiency Must Increase to Meet Productivity Expectations

Although fixed equipment costs can be amortized over large numbers of compounds, capital outlays can still be quite substantial for robotic equipment, supplies, laboratory space, computer hardware/software, and, of course, the associated, substantial expenses of HTS. The cost of large purchased libraries can also make a substantial contribution to the total tab, as do trained personnel. HTS throughput now approaches 100K samples/machine/day from several manufacturers, but only certain CC technologies approach this level of output. And, as always, generating massive amounts of data on biologically inappropriate targets does not improve overall efficiency.

5) Acceptance of CC Depends on External Technologies for "Success"

CC will always be judged by the overall success of the total CC/HTS paradigm in delivering "better" leads into development more quickly and at lower overall cost (exactly what constitutes "better" is subject to debate). Despite the fact that big pharma has internalized the technology, it remains a tentative embrace. The bottlenecks have now moved to high throughput ADMET and process development. Will CC/HTS be able to deliver more, or more robust, compounds to the clinic?

6) Constant Stream of New Chemistries/Technologies are Vital to Survivability

Adoption of classical chemistries and technologies to—or invention of new ones for—miniaturized solution or solid-phase conditions is a slow step in CC. There will be a constant demand for new chemistries for the creation of new building block "monomers" as well as for the formation of backbones. Microfluidics based syntheses present new technical challenges for chemistries but can reduce costs and may challenge the current market equilibrium.

7) Viability of the CC Paradigm Must Still Be Proven

Any new paradigm (e.g. molecular modeling and QSAR in the '70s and '80s, or computational chemistry in the '80s-'90s) needs to prove itself. Whether CC delivers on its promises remains to be seen. However, there are a number of initial successes to bolster further investment and study.

8) Consumer Orientation of Individual Companies Determines Success

Suppliers base their marketing on their IP and their fortunes can go in and out of favor as opinions change and new technologies come online. For example, peptides were the first type of compounds produced combinatorially, and generated much early excitement, but peptides are now only a small segment of the market. Most peptide libraries are now used for assay validation, rather than for new drug discovery per se.

9) Development of Non-pharma Segments Needed to Provide Growth

The use of CC in the agrochemical sector has started, but will take a few more years to reach a significant portion of the biopharma market. Use of CC in materials research (catalysts, plastics, paints, etc.) is just beginning with a small number of new companies in formation following Symyx's lead.

New Report from Frost and Sullivan (Back to Top)

The U.S. Combinatorial Chemistry Libraries Market (Frost & Sullivan report #5821-55) is a newly issued, comprehensive report from the Healthcare Drug Discovery Technologies group. The report gives a thorough discussion of market challenges, drivers, restraints, and segmentation. Extensive tables profile 32 major CC libraries suppliers, mergers and acquisitions, deals, strategic changes in business models, and strategies and tactics for competing in this changing market. Extensive data and analysis is presented on supplier and consumer issues and perceptions, as well as a quantitative model of revenue and market shares by business model for the period 1998–2003.

For more information: Nick Mariottini, Frost & Sullivan, 2525 Charleston Rd., Mountain View, CA 94043. Tel: 650-237-4382. Fax: 650-968-1333.