Emerging Partnership Trends In Oligo-Based Medicines

A conversation with Carl Schoellhammer and Phillip Leclair, DeciBio Consulting

The oligonucleotides sector is quickly evolving and we are seeing more industry partnerships than ever before. We caught up with Carl Schoellhammer, Ph.D., associate partner and practice lead of DeciBio Consulting’s advanced therapies practice, and Phillip Leclair, an associate at DeciBio, for their analysis of the space.

How would you characterize the current partnering landscape in the oligo/RNA space? Have there been any significant shifts in which modalities are trending over the past year or two?

Partnerships are a critical source of validation and capital to expedite the development of drug candidates. As the field of oligos and RNA has matured, biopharma’s interest in the space and appetite for partnerships has increased. These modalities are now important tools in the therapeutic armamentarium for patients and can provide needed new commercial franchises to their sponsors and partners. As a result, the partnering landscape across oligos and RNA has seen notable shifts recently. mRNA was the world’s focus during the pandemic to the detriment of oligos. The field is now shifting back to oligos and the potential benefit they can provide. This is driven by the general maturity of these modalities, which include several approved and successful marketed products, including Biogen’s Spinraza, Alnylam’s Onpattro, Oxlumo, and Amvuttra, Ionis’s Tegsedi, Qalsody, and Waylivra, as well as Novartis’s Leqvio and Novo Nordisk’s Rivfloza. These products collectively generate billions in annual sales, underscoring the significant commercial success of oligos and their importance as therapeutic options for patients.

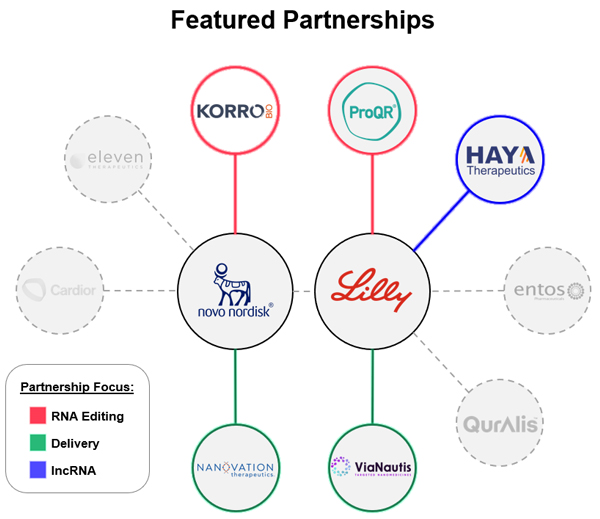

This track record of approved products has refocused interest in oligos and antisense oligonucleotides (ASOs) within the industry. Meanwhile, recent progress in RNA editing has further stimulated excitement and new partnerships. Companies like Wave Life Sciences have recently released clinical data on their RNA editing program, which serves to de-risk the technology and enhances its attractiveness to potential partners. Companies such as Korro Bio and ProQR are also advancing RNA editing technologies and assets. For example, Korro Bio’s partnership with Novo Nordisk and ProQR’s with Eli Lilly signify significant interest and potential growth in RNA editing, a strategy that allows precise RNA modifications without altering the underlying DNA. This increased attention is likely to lead to more partnerships and further development within RNA editing and oligo modalities.

What external market-based factors and industry challenges do you see underpinning these partnership decisions?

Biopharma is facing unprecedented levels of revenue on franchises facing near-term loss of exclusivity. The industry, facing both a complex economic environment and tightening R&D budgets, is focusing more on established “tried-and-true” modalities, including biologics, oligos, siRNA, and ASOs. Proven platforms with a history of success, like oligos and ASOs, are more attractive over novel target or drug development and the timelines and budgets that are associated with that. At the same time, biopharma needs to see compelling proof-of-concept data, which is critical for larger partnerships. Large pharma, to assess the level of technical risk associated with an asset or technology, is typically wanting to see robust animal or even non-human primate data before committing to a deal.

Additionally, efficient delivery remains a crucial challenge, with most oligo therapeutics historically targeting the liver due to challenges with extra-hepatic delivery. Expanding beyond hepatic targets requires novel delivery mechanisms and targeting strategies, including the development of effective binders and other innovative vehicles. The pursuit of partnerships with companies developing advanced delivery platforms is, therefore, likely to continue.

If you had to pick two or three recently forged oligo-centric partnerships that hold the most promise for the future advancement of the RNA space, which ones would they be, and why?

One potentially interesting partnership is Haya Therapeutics’ collaboration with Eli Lilly. Haya is focused on long non-coding RNAs (lncRNAs), a class of RNA once considered “junk” but now appreciated for their essential roles in cellular processes. This partnership aims to uncover drug targets within lncRNAs and potentially create a new category of RNA-based targets and resulting therapeutics. Haya’s capabilities in exploring lncRNAs would seem to give it a strong position to unlock this underexplored domain, potentially adding transformative options to the therapeutic arsenal.

Another interesting partnership is Korro Bio’s alliance with Novo Nordisk. Korro Bio is also developing RNA editing strategies and therapeutics. This is an area that has seen recent positive data clinically for the first time from Wave Life Sciences. As one of several companies focused on RNA editing, Korro Bio’s work with Novo Nordisk could spur new advancements, expanding the RNA space into an entirely new modality with the promise of reversible gene modulation. Additionally, ProQR’s preexisting partnership with Eli Lilly has a similar focus and could help further unlock RNA editing.

Where do you see the greatest opportunities for innovative partnerships in the RNA space? What may be overlooked? Are we starting to see any rumblings of potential partnerships in these areas?

Several areas in oligo therapeutics present untapped opportunities for innovation and partnerships, each holding considerable potential:

- AI and Computational Models for Genetic Medicines: While AI has garnered much attention for small molecules and protein therapeutics, its application to RNA and genetic medicines remains relatively underexplored. RNA therapeutics could benefit from AI models designed for sequence discovery and optimization. Unlike the seemingly fragmented data that limits AI’s impact within small molecule development (as each pharma company trains their own models on their own internal data), it would seem as though genetic medicines could benefit more greatly from the implementation of AI models. Comprehensive sequencing of target genes and associated pathways could be fed into these models to allow a more “complete” data set from which the model can begin to mine and move forward. This area represents a significant opportunity for companies that can harness data and deploy predictive AI to accelerate development of oligo therapeutics.

- RNA Editing: As mentioned, RNA editing is in its early days but is attracting attention due to its potential for precise RNA modification without permanent genomic changes. This transient and adjustable approach offers the potential for redosing or even discontinuing therapy, which is particularly attractive in therapeutic areas where permanent changes may not be ideal. One could imagine that the recent positive results from Wave Life Sciences will help further catalyze additional partnerships in this area.

- Delivery Mechanisms: Delivery remains a longstanding hurdle for genetic medicines, as RNA therapies are only as effective as their delivery systems. While liver-targeted therapies are common, expanding oligo therapeutics to non-hepatic tissues is critical for addressing a broader range of diseases. Companies working on novel delivery vehicles, such as binders and targeting strategies, are highly attractive as partners in this field. Recent partnerships illustrate this interest. For instance, ViaNautis Bio signed a deal with Eli Lilly to leverage its polymeric “polyNaut” platform. Similarly, NanoVation partnered with Novo Nordisk to advance delivery technologies for rare and cardiometabolic diseases. These partnerships are emblematic of the need to develop better delivery vehicles to go beyond the liver.

Each of these emerging areas — AI-powered genetic discovery, RNA editing, and advanced delivery — holds the promise to overcome key limitations within oligo drug development. During the pandemic, oligos took a backseat as mRNA stole the spotlight, but they’re now experiencing a resurgence in partnership activity and new company formation. With renewed attention and a growing number of partnerships, these once-overlooked modalities are receiving the recognition they deserve.

About The Experts:

Carl Schoellhammer, Ph.D., is an associate partner and leads DeciBio’s advanced therapies practice. He has experience across biopharma, manufacturing/bioprocessing, and supply chain considerations. He has executed on projects related to pipeline prioritization and life cycle management, indication road mapping, growth strategy, and M&A, across healthcare, life science tools, and pharma (cell and gene therapies). Previously, he co-founded and led Suono Bio, a therapeutics startup. Schoellhammer holds a B.S. from the University of California, Berkeley, and a Ph.D. from MIT, where he trained with Prof. Robert Langer.

Carl Schoellhammer, Ph.D., is an associate partner and leads DeciBio’s advanced therapies practice. He has experience across biopharma, manufacturing/bioprocessing, and supply chain considerations. He has executed on projects related to pipeline prioritization and life cycle management, indication road mapping, growth strategy, and M&A, across healthcare, life science tools, and pharma (cell and gene therapies). Previously, he co-founded and led Suono Bio, a therapeutics startup. Schoellhammer holds a B.S. from the University of California, Berkeley, and a Ph.D. from MIT, where he trained with Prof. Robert Langer.

Phillip Leclair is an associate at DeciBio Consulting specializing in next-generation therapeutics. He has substantial experience in market landscaping, competitive analysis, and strategic partnership development for leading life sciences and therapeutics companies, supporting innovation in oncology and adjacent fields.

Phillip Leclair is an associate at DeciBio Consulting specializing in next-generation therapeutics. He has substantial experience in market landscaping, competitive analysis, and strategic partnership development for leading life sciences and therapeutics companies, supporting innovation in oncology and adjacent fields.