Human Biological Samples Sourcing: An Overview

By Mathini Ilancheran, principal analyst, R&D, Beroe Inc.

By Mathini Ilancheran, Lead Analyst, Clinical Research, Beroe Inc. and Samiya Luthfia Khaleel, Senior Research Analyst, Clinical Research, Beroe Inc.

Abstract & Problem Statement

Human Biological Samples (HBS) are collected during a biopsy or surgery to diagnose the patient and are preserved for later use by researchers to study the disease progression to bring about potential benefits to the patient community. Despite the varying regulations, HBS collection and biobanking has evolved throughout the years. The Biospecimen collected encompasses important phenotypic, genomic, and proteomic information related to a specific population or a specific disease. Utilization of this information in research has led to innovative drugs, creating personalized medicine according to the patient’s genetic profile.

Animal models have been used in discovery and pre-clinical research stages to obtain data which can be extrapolated to apply to human conditions. The animal model does not reiterate the effects precisely in humans, as they differ in the metabolism and are exposed to environmental factors.1 Alternatives like human tissue can reduce the overall early development research costs. Instead of using animal models for toxicity testing, use of donated human tissues had a precision rate of 85 percent, hence enabling accurate information when compared to the experiments in animal models.2 This is also regarded as an enrichment strategy by the FDA during clinical trials to support drug product approvals. Big pharmaceutical companies partner with both commercial and public biobanks for sample procurement and genotyping. The recent deal between AstraZeneca and Montreal Institute in 2015 to genotype up to 80,000 patients for genes associated with cardiovascular diseases and diabetes is one good example of the collaborative efforts happening within the HBS market.3

This whitepaper discusses the trends, supplier landscape, and segmentation by providing visibility to the HBS market and the benefits of engaging with a commercial vs. public biobank.

Introduction

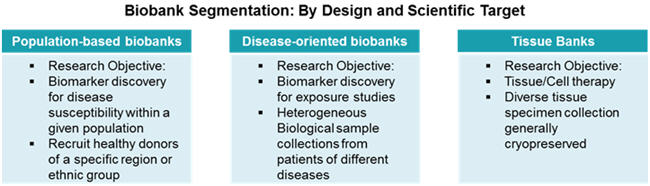

Biobanks are large collections of human biological materials (biospecimens) from one or several human beings collected and stored indefinitely for a specified time. They collect, store, and distribute human tissues for research purposes.4 These human biological samples are procured by pharma and are used throughout the drug development value. There are three main types of biobanks based on design and scientific target: Population-based biobanks, Disease-oriented biobanks, and Tissue Banks. The description for each is provided in Figure 1 below.

Sources: Supplier Interactions, JRC European Commission

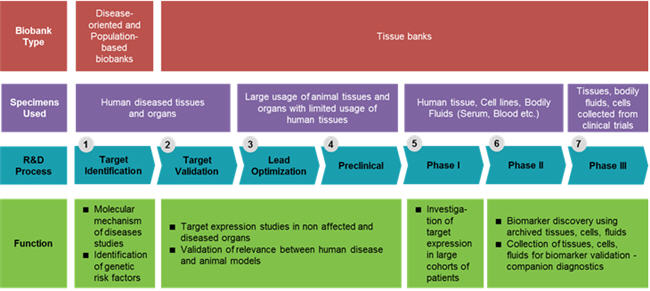

There is a need for human diseased tissues, organs, cell lines, and bodily fluids, particularly in the target identification, validation, and Phase 1 through Phase 3 fields of the drug discovery and development process. 5 Figure 2 below shows the functional use of human biological samples (HBS) within the entire R&D value chain.6

Sources: social.eyeforpharma.com 6, Beroe Analysis

Human Biological Samples Market

The global Human Biological Samples market is estimated to be $1.6 Billion in 2013, growing annually at a CAGR of 15.9 percent during 2012 to 2013 (Figure 3). One of the key factors resulting in market growth is the increasing prevalence of chronic diseases such as cardiovascular disease, neurovascular disease, cancer, diabetes, and respiratory disease. 7 This has further resulted in increased use of human tissue suppliers by pharmaceutical and biotechnology companies for its use in the drug development process. Increase in population genetic studies, personalized medicine, and the use of genetic information in forensics, food safety, and disease surveillance are the other factors driving the need for human biological samples.8 Oncology as a therapeutic area is the largest focus in terms of revenue. However, Cardiology is growing fast at the rate of 16.24 percent between 2011 to 2016.9

Approximately 70 percent of the biobanks are part of an Academic/Research institute. The remaining 30 percent are commercial biobanks, out of which CROs form a negligible percentage as shown in Figure 4 below. Commercial biobanks are expected to increase with a growth rate of 64 percent at a five-year CAGR of 10.4 percent.

Population biobanks are anticipated to increase by 27 percent, with 5 percent CAGR and disease-based biobanks expected to increase by 6 percent, at a CAGR of 1.2 percent during 2009 to 2014.10 DNA, serum, whole blood, and tissues contribute to the majority of samples i.e. 80 percent, that is stored by biobanks. However, those who provide tissues, along with DNA, serum, and whole blood contribute to 7 percent only. 11

HBS Supply Market

For biobanking, European and North American markets are considered developed as they have established the largest biorepositories and tissue banks. Europe holds the largest biobank market due to high demand from Germany, Italy, The Netherlands, and The U.K. as a result of funding grants offered by public bodies for maintenance of biobanks in these regions. E.g. U.K. Biobank, National Biobanks of Finland, PKU Biobank, Karolinska Institutet Biobank, etc. The USA holds the second largest position in the biobank market. When compared to Europe, it falls behind in terms of funding grants offered. E.g. Coriell Institute for Medical Research, Indiana Biobank, etc.

The Asia Pacific region is considered an emerging market for biobanking, as very few biobanks have their presence here. Regulatory, ethical, and social concerns in China impede the development of biobanks as cross border sharing of HBS from China to anywhere else is strictly prohibited. Underutilization of biobanks in Asia is also a reason for their limited presence. However, the rapid population growth in Asia pacific regions may in the future affect the market of developed countries. Social controversies and protest against collection and usage of human samples from indigenous groups for genomic research has restricted the presence of any biobanks in the Latin American region as well. Nevertheless, procurement of HBS from the Latino population could be done from North American biobanks. E.g. Mayoclinic’s Arizona biobank facility.12

Supplier Segmentation

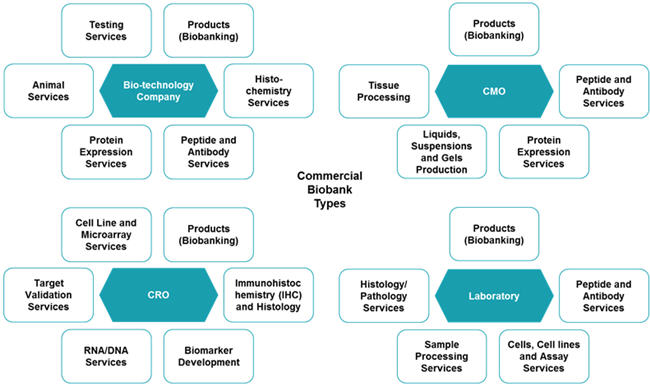

Within the HBS market, there are biotechnology companies, Contract Research Organization (CROs), Contract Manufacturing Organizations (CMOs), and laboratories, which fall under the commercial service provider marketplace. These companies offer sample testing, collection, and management, as well as other discovery and clinical services. They also have local distributors worldwide with regional expertise to enable material transfer with ease. Figure 5 below shows the various services that could be bundled along with HBS procurement for each supplier type.

Source: Beroe Analysis

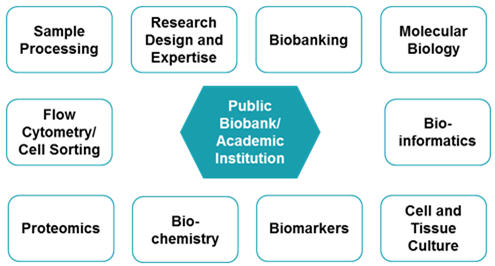

There is also a presence of public biobanks as shown in figure 6 below. Public biobanks do have restrictions on the sample procurement to their members only. However, not all biobanks have this restriction. Biobanks who do not have this restriction offer subsidized rates for their members and regular prices for non-members. For services such as research design and expertise, resources in the form of scientists are offered. They perform a variety of services such as cell lines, DNA/RNA isolation, Data analysis etc., which are bundled along with sample procurement.

Source: Beroe Analysis

Procurement of HBS can be done from a commercial or a public biobank. Convenience, customized procurement, and diversified samples are prioritized in procurement; a commercial biobank would be a suitable option for HBS procurement. Online portals (online biorepository) in a commercial biobank make the process of purchasing samples easier when compared to the manual process in public biobanks, wherein a service request form needs to be completed with the principal investigator’s details and submitted. Commercial biobanks have regional distributors which are able to negotiate local regulatory stringency in procuring HBS. However, on the other hand, public biobanks are able to offer subsidized rates for members and to give access to research samples which commercial banks cannot provide. Based on the budget and the purpose, pharma companies could engage with either of these for their sample procurement.

Conclusion

The HBS market is highly regulated, with multiple regulatory bodies for each country within a given region. This acts as a hurdle in cross-border sharing of samples and also difficulty in tracking the right samples for the researchers internationally. As a way to ease out cross-border sample procurement, organizations that harmonize the biobanking activity have been created to facilitate the HBS supply through public funding. Biobanking and Biomolecular Resources Research Infrastructure (BBMRI), International Agency for Research on Cancer (IARC), International Society for Biological and Environmental Repositories (ISBER), National Cancer Institute (NCI), and Public Population Project in Genomics (p3G) are some of the consortiums that were formed to help the harmonization of ethical, legal, and scientific issues involved in biospecimen research or managing biorepositories. 11, 13 Pharma companies that are members of these consortiums are benefited by the analysis tools, infrastructure, and networking opportunities among member biobanks, hence enabling access to samples of partner biobanks on a non-economic basis.

References

- National Anti-Vivisection Society (NAVS). 2014. http://www.navs.org/science/failure-of-the-animal-model

- New England Anti-Vivisection Society (NEAVS). Alternatives In Testing. http://www.neavs.org/alternatives/in-testing

- AstraZeneca. AstraZeneca and Montreal Heart Institute to screen 80,000 samples . May 13, 2015. http://www.astrazeneca.com/Media/Press-releases/Article/20150513-astrazeneca-and-montreal-heart-institute-to-screen

- Akintola, Simisola O. "Ethical and Legal Issues in Biobanking for Genomic Research in Nigeria." NCBI, 2012: 16–25. http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3863711/

- Swifka, Janine, and Arndt A. P. Schmitz. "Pharma Research Biobanking: Need, Socioethical Considerations, and Best Practice." In Modern Biopharmaceuticals: Recent Success Stories, by Dr. Jörg Knäblein. Wiley-VCH Verlag GmbH & Co. KGaA, 2013. http://onlinelibrary.wiley.com/doi/10.1002/9783527669417.ch12/summary

- Genovesi, Lina . The Pharma Potential to Tap into Biobanks. July 2013. http://social.eyeforpharma.com/research-development/pharma-potential-tap-biobanks

- Transparency Market Research. Biobanks Market - Global Industry Size, Share, Trends, Analysis And Forecast 2012 - 2018. Transparency Market Research, 2012. http://www.transparencymarketresearch.com/biobanks-market.html

- Fisher, Daniela. The future of biobanking. January 2013. http://biotechnologyfocus.ca/the-future-of-biobanking/

- HUNT Biosciences. Business Plan Update. HUNT Biosciences , December 2013. http://www.ntfk.no/bibliotek/saker/2014/FT/Vedlegg%20februar%202014/Vedlegg%201%20Hunt%20Biosciences.pdf

- BCC Research, giiresearch. Biobanking: Technologies and Global Markets. Industry Analysis, BCC Research, 2012. http://www.giiresearch.com/report/bc204227-biobanking-technologies-global-markets.html

- Zika, Eleni , et al. Biobanks in Europe: Prospects for Harmonisation and Networking. Scientific and Technical, Luxembourg: JRC European Commission, 2010. http://ftp.jrc.es/EURdoc/JRC57831.pdf

- visiongain . BIOBANKING FOR MEDICINE Business Intelligence, Vision Gain, 2014. https://www.visiongain.com/Report/1229/Biobanking-for-Medicine-Technology-Industry-and-Market-2014-2024

- hSERN : Human Sample Exchange Regulation Navigator. Human Sample Exchange Regulation Navigator. http://www.hsern.eu/

About the Authors:

Mathini Ilancheran is an experienced analyst in the Pharma R&D vertical. She specializes in understanding the market scenario and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. She completed her Masters in Management from University College London and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. She is also an engineer with a background in bioinformatics and has experience as a research fellow in Singapore-Delft Water Alliance (SDWA), NUS, with active involvement in scientific tool development and programming.

Mathini Ilancheran is an experienced analyst in the Pharma R&D vertical. She specializes in understanding the market scenario and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. She completed her Masters in Management from University College London and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. She is also an engineer with a background in bioinformatics and has experience as a research fellow in Singapore-Delft Water Alliance (SDWA), NUS, with active involvement in scientific tool development and programming.

Samiya Luthfia Khaleel started her career as a Drug Discovery Scientist, enabling her to connect science and procurement in pharmaceutical R&D. She completed her Masters in Biomedical Sciences from Aston University, completing her thesis on asthma and COPD treatments. She is also an engineer with a background in Industrial Biotechnology and has experience conducting research on generating electricity from tannery waste water.

Samiya Luthfia Khaleel started her career as a Drug Discovery Scientist, enabling her to connect science and procurement in pharmaceutical R&D. She completed her Masters in Biomedical Sciences from Aston University, completing her thesis on asthma and COPD treatments. She is also an engineer with a background in Industrial Biotechnology and has experience conducting research on generating electricity from tannery waste water.